A partner through it all.

Founded on knowledge, driven by relationships, inspired by community.

Meet Our Team

At Cavignac, our vision is a community where every business is protected from risk.

We give confidence and clarity to companies like yours by providing knowledge-based risk management solutions and an exceptional client experience.

TotalRISK Approach® summarizes our philosophy on Risk Management. One way we holistically manage risk is by following a defined, results-driven Risk Management process. This process is four steps and is designed to continually improve the company's Risk Management Practices.

Looking for a truly fulfilling career?

We've built the best team in the industry by empowering them to:

Belong

We emphasize culture and encourage collaboration. In our supportive work environment, you know your teammates have always got your back.

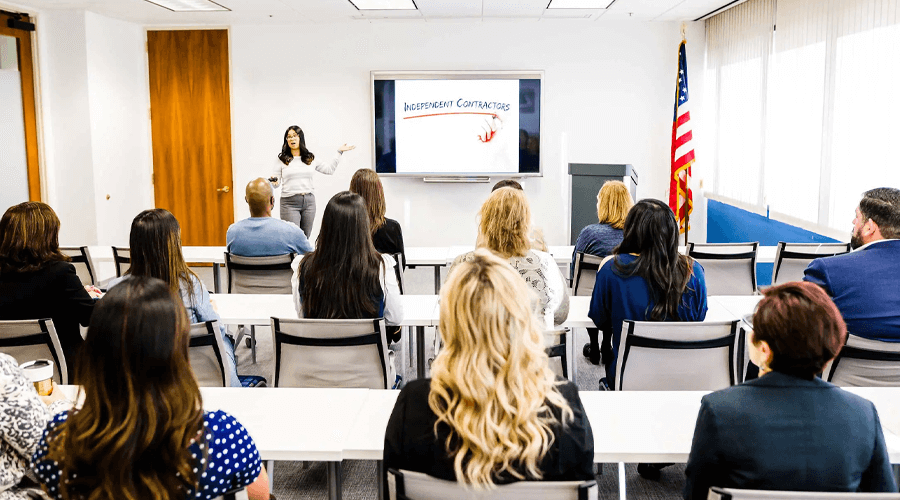

Grow

The only thing more important than our clients’ futures are those of our team. We invest 3x what other brokerages spend on education.

Give

We believe community is integral to a fulfilling career. We’re always looking for ways to give back to the place where we live and work.

Thrive

Comprehensive health, 401(k) matching, profit sharing, competitive PTO, generous bonuses, team events—we give our team the benefits they need to live their best lives.

Just ask our team!

We've built the best team in the industry by empowering them to:

Director of First Impressions

Varita Kirtley

Client Manager

“I’ve had the pleasure of working at Cavignac for 6 years. I cherish our respectful work place and the invaluable shared Agency bonus program. I’m grateful for the growth I’ve continued to experience and the opportunity for future growth.”

Sherri Irvin

Senior Client Manager

“After working at Cavignac for almost 5 years, it’s easy to see why they invest in their people. From supporting educational goals to personal development, it’s always about making the company better by making the people better.”

Dan Smith

Claims Risk Advisor

Anissa Stepp

Senior Client Manager

Dan Smith

Claims Risk Advisor

Director of First Impressions

Varita Kirtley

Client Manager

“I’ve had the pleasure of working at Cavignac for 6 years. I cherish our respectful work place and the invaluable shared Agency bonus program. I’m grateful for the growth I’ve continued to experience and the opportunity for future growth.”

Sherri Irvin

Senior Client Manager

Anissa Stepp

Senior Client Manager