You are the owner of a construction company with a never-ending list of responsibilities. One responsibility that is likely being delegated (and should be) is billing. The question is – does your billing department understand the critical importance of their job in the company? Or maybe a better question is, do you realize the impact that a lax or inconsistent billing department can have on your company and its ability to grow?

Working capital (your company’s liquidity, or current assets, less current liabilities) is a primary component of most sureties’ credit analysis, and therefore has a major impact on the overall terms and size of your bonding program. If the company is slow to issue billings or does not pursue approvals for change orders (“C/O”) in a timely manner, you may be left with a lack of working capital or cash flow issues and in turn, a reduced ability to bid new work.

Here are some common assessments by sureties or other creditors when delinquent receivables or large underbillings arise:

- May suggest a lack of (or poor) internal policies and procedures

- Difficult to determine the true working capital of a company

- The company is recognizing revenue for unapproved change orders

- What is the likelihood the change order will be approved, or is actually approved for that amount? As we all know, the contractor loses leverage once the work is performed, and it is not uncommon for the final C/O to be a lesser amount. This would result in a revenue write-down, which would fall directly to your bottom line (not to mention the asset being eliminated).

Point #3 above is critical – below is an example of exactly how your company’s bondability can change in a very short period of time.

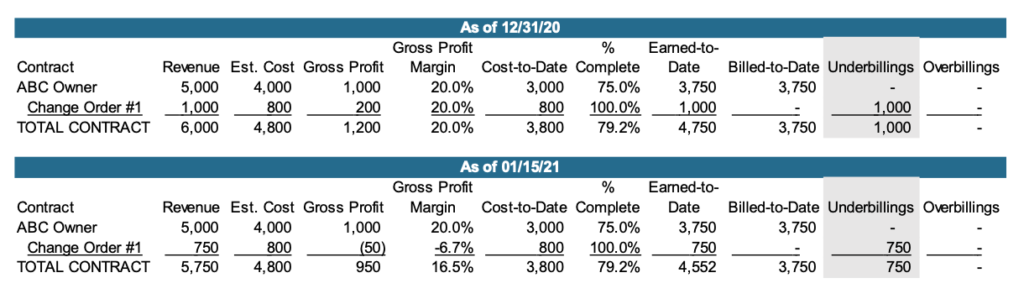

Ex. The company has a $5,000,000 contract. In November, the contractor realizes there is a design flaw that needs to be corrected and notifies the owner of a $1,000,000 C/O, which includes the same margin as the original contract (20%). The owner directs the contractor to proceed with the corrective work, indicating they will work on approving the C/O. Come year-end, C/O work is complete and the remainder of the project is 75% complete. The contractor now shows a $6,000,000 contract on their Work-in-Progress schedule due to the owner’s verbal instruction to proceed. When the owner finally gets around to approving the C/O in the following year, they determine they are only willing to approve $750,000 for the work – as the contractor, your cost doesn’t change. In this scenario, that means the contractor will be starting out their next year with an operating loss right out of the gate. Let’s take a look at the change in the contractor’s WIP over a two week period, which assumes no additional work was completed (amounts in thousands):

As you can see, underbillings decreased by $250,000 based simply on the owner’s final decision of the change order amount. That means a $250,000 asset was just eliminated from the contractor’s balance sheet (poof!). Now look at gross profits, where a dollar-for-dollar write-down has occurred. The contractor reported gross profits of $1,200,000 in fiscal year 2020. Now that the C/O is approved (two weeks after fiscal year end), the company is starting the 2021 fiscal year at a $250,000 loss.

While this is a fairly basic example, you can see why sureties focus on underbillings, and in many cases will discount them if the status of a contract increase is unknown. Assuming all else remains equal, this contractor just lost $250,000 in working capital. If your surety looks for you to maintain 10% working capital compared to your cost backlog, you just lost the capacity for an additional $2,500,000 in new contracts.

Now let’s consider accounts receivable. If your billing department falls behind for only one month, the effects could be lasting. Say you miss a monthly billing to a public works owner, who in most cases, does not allow a revised billing to be sent. This means you have to wait until the next billing cycle to catch up. If the owner is a 60-day payor (one can only hope), that leaves a chance your missed billing could be 90 days past due when you report quarterly results. Why does that matter? It will crush your working capital because any account that is over 90 days past due is considered a long-term asset by sureties. The best way to avoid surety tightening – have best-in-class billing policies and practices to avoid delinquent billings.

If any of you have ever been constricted by a surety due to a bad year, or even one bad quarter, you know that it can be a long road back into their good graces – regular meetings, follow-ups, and additional questions to address when going over your financial results. So, the best approach – eliminate these problems before they occur.

Our agency works with our clients on their Financial Risk Management, which can help avoid unexpected restrictions on your surety program. We work proactively with you to improve internal processes and drive best practices to reduce the likelihood of issues like those discussed above. A major part of obtaining surety credit is managing expectations, and we can work with you to make sure your surety program is consistent and growing. If you have questions about your working capital position, or are interested in approaches to enhance your company’s credit profile, please don’t hesitate to contact our agency.