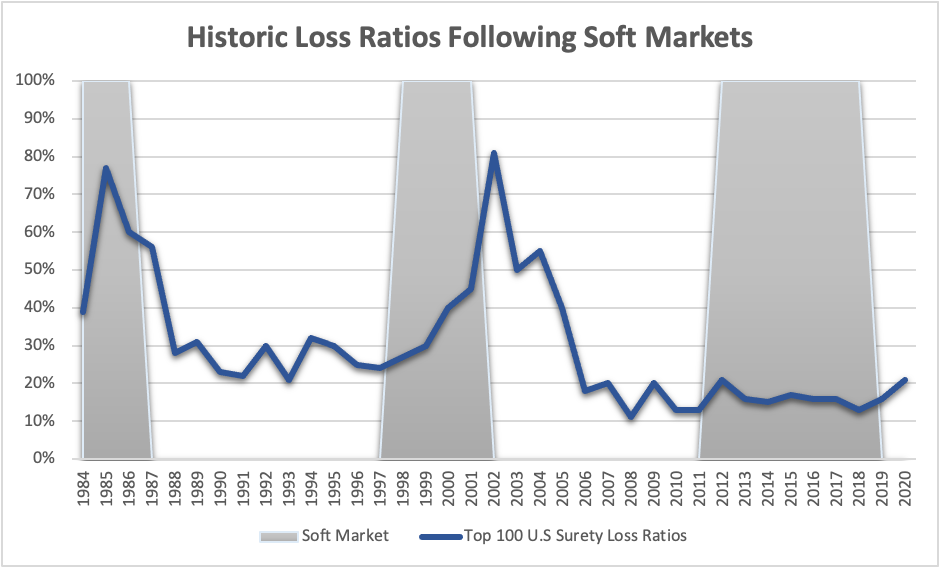

Entering 2020, the overall surety market had been experiencing the longest expansionary period in history; with Direct Written Premium growth of nearly $2B since 2012. This record expansion resulted in very relaxed underwriting guidelines, new companies entering the bonding arena and ultimately a significant surplus of credit.

Now as we near the end of 2020, the impact of the current economic uncertainty has begun to surface. It is anticipated that the construction and surety markets will continue to see signs of stress through 2021 and likely in to 2022. Compared to other insurance products, economic cycles affect bonding more so than any other insurance sector.

When the overall economy is doing well, surety loss ratios are low and credit becomes more available and relaxed. Conversely, when the economy experiences a downturn, loss ratios increase and credit becomes scarce along with tightening underwriting terms and conditions.

Source Data: Surety & Fidelity Association of America (SFAA)

Typically, the surety industry doesn’t experience losses for 18-24 months after an economic boom when contractors’ have worked off healthy backlogs. Unfortunately, under the current unprecedented economic conditions, it is harder to predict the next economic downturn. Contractors and sureties could experience losses much more quickly than we’ve seen in past cycles.

The success of most contractors in the future will be dictated by the strength of their backlogs, management teams, balance sheet and availability to obtain and manage credit (i.e. Surety, Bank Lines of Credit, SBA or other Terms Loans, Project Payment Schedules, etc.).

With baby-boomer owners facing another economic cycle and a continuous push for heavy technology investments, we will likely see a further tick-up in mergers and acquisitions of contractors in 2021 as the construction landscape continues to evolve.