The following was featured in Construction Executives.

As we reflect on the dynamics of the Construction industry in 2023, it is evident that opportunities and challenges have emerged for contractors which will shape the landscape for the year ahead. This article is meant to provide a high-level overview of some trends anticipated in 2024, and recommendations on how contractors can not only capitalize on these trends but protect the successful companies they have already built. Consider this a checklist of topics you should be familiar with and ideas to be evaluated (and implemented) in your organization.

Project Opportunities

There has been a notable increase in public works opportunities, driven by increased government spending and the aging infrastructure in the United States. We expect this trend to continue in 2024 and beyond, with a notable portion of work coming in the transportation and public utility-related infrastructure. Due to increased spending, many contractors are reporting historically high backlogs – and that often includes the largest project their company has contracted in their history. While increased spending presents more opportunity, it’s critical contractors be even more diligent about new opportunities, giving additional consideration to the following:

- Job Selection – “stick to your knitting”. New geographies, scope, project owners and/or subcontractor relationships commonly come with a learning curve. With the current state of the market, it’s not the ideal time to be learning costly lessons. Contractors should focus on having a proactive “Go / No-Go” strategy when reviewing potential projects to identify risks early and plan accordingly.

- Margins – contractors’ pricing was slow to catch up with material and labor cost escalations, which is reflected in the 2023 financial results. Contractors should internally set an acceptable floor for project margins and include ample contingencies to cover unforeseen challenges.

- Contract Terms – litigation is increasing, and contract terms are arguably becoming more onerous for contractors (and their subcontractors). It is imperative proposed contracts are reviewed prior to bidding, to identify both upstream and downstream risk. Timely submission of pre-bid Requests for Information (“RFI”) are critical in identifying risks in new projects and pricing them accordingly.

- New Entrants – increased competition for work should be expected. Given the slow-down in private development, it is likely that contractors who do not typically pursue public works will step into that arena.

Surety Market

The surety market continues to grow, but there have been signs of more challenging times ahead. An increase in Payment Bond claims began to emerge in early 2Q 2023, which is often a precursor to future performance claims (subcontractors not being paid typically suggests challenges upstream). Towards the end of 3Q 2023, the trend proved itself as more Performance Bond claims began to arise. Based on early indications of contractors’ financial performance in 2023, it’s expected this trend will continue in 2024 as the viability of some construction companies has been called into question. On the other hand, although surety losses have increased, it’s important to note they are largely attributed to a handful of markets and reserves remain high to handle these losses. As surety companies and their reinsurers respond to these losses, it is essential for contractors to align themselves with an experienced surety broker who can navigate today’s evolving market conditions and some of the following industry shifts:

- Field Authority – contractors should expect underwriting authority to be reduced in the field and more decisions being reverted to a more conservative home office. This means additional layers for approvals, and the underwriter who you (should) know personally, may no longer be making the decision on new project pursuits. It is critical you and your broker know who has the authority to make decisions and support your overall business plan.

- Subcontractor Bonding – it is apparent more bonds are being required of subcontractors. Whether this is a surety’s condition, or possibly a lender providing financing for the project, it is an important risk-sharing practice for General Contractors (GCs), and subcontractors should expect to need expanded surety capacity. GCs should be sure to account for additional bond premiums when requesting subcontractor bids, and subcontractors should work proactively to make sure they have a competitive premium rate.

- Insurance Impacts – while surety bonds differ from insurance policies, most surety bonds are written by insurance companies. It has been widely reported that insurance premiums are increasing as the industry continues to endure increased catastrophic losses, social inflations, etc. While surety tends to be a more profitable part of insurance companies’ operations, it should be expected that losses in other areas of their business may further the tightening trend by some sureties.

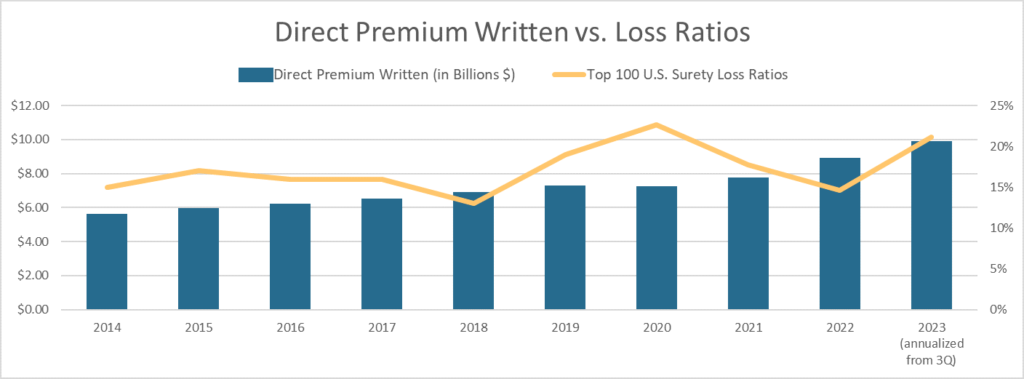

The chart below illustrates the trend in direct premium written over the last ten years, as well as the reported loss ratios over the same period. Surety companies typically underwrite to a loss ratio in the low 20% range. 2020 came very close to a breakeven year for the industry, and government stimulus helped contractors avoid increased claims in 2021 and 2022. The last column shows 2023 is looking similar to 2020 results; however, with no additional government stimulus expected, we expect this trend to continue and potentially increase in 2024 and 2025.

Source: SFAA / Prior 10 Years Direct Premium Written and Loss Ratios for U.S. Surety Companies

Interest Rates

The “Prime Rate” currently sits at 8.50%. If you can believe it, this index has not reached that level since February of 2001, meaning we have not seen the toll higher interest rates can take in over twenty years. Contractors should focus on preserving cash and avoiding new interest-bearing debt. There have been some indications suggesting some reprieve from current rates later this year, but at this point that is pure speculation. Even if the Federal Reserve does decide to reduce the benchmark rate, it will be a slow reduction and the challenges of high interest-bearing debt will persist. Some ideas for dealing with the current rate environment might include:

- Expand Trade Lines – many contractors have established trade lines with their suppliers, and these are often based on a supplier’s history with the company and relationship. Any additional capacity and/or more favorable terms will provide an alternative to cash-flowing these types of purchases with more costly, interest-bearing debt.

- Dealer Financing – take time to evaluate all options when it comes to dealer financing and most notably, equipment dealers. These companies have a unique structure that don’t necessarily factor in market rates to the extent a traditional bank might. Terms from auto dealers are typically more in line with traditional banks, but worth evaluating if making multiple/bulk purchases for a fleet.

- Interest-Bearing Deposit Accounts – there is a positive to higher interest rates in that you can finally earn some money on your cash. Most banks are now offering rates ranging from 2.50% to north of 5.00% for Money Market accounts depending on the balance maintained. If you have significant reserves, cash monitoring should be even tighter to ensure interest income is maximized.

- Bank Line of Credit – maintaining a working capital line of credit is a necessity for contractors, and existing limits should be increased if possible. Contractors who utilize their line of credit should actively manage the balance, reducing the balance as much as possible and only drawing when absolutely necessary. If a bank sees the balance is consistent, they will likely deem that amount “permanent capital” and propose the balance be termed out (converted to amortizing debt). This would lock the contractor into an unfavorable rate and fixed payments for three years or more on the balance.

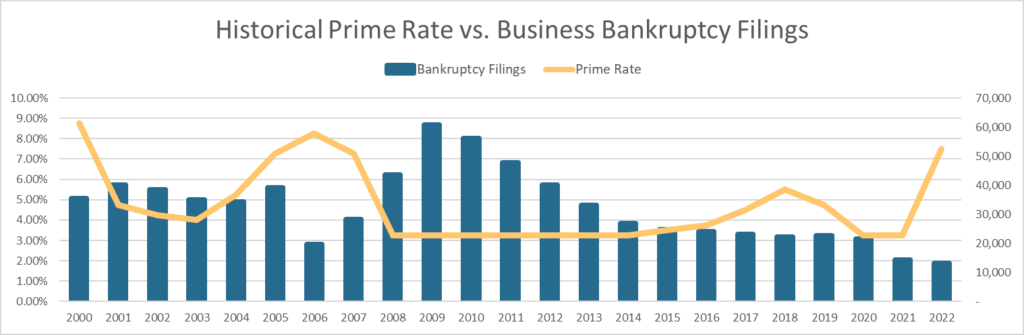

The chart that follows reflects the historical Prime Rate compared to the number of businesses filing for bankruptcy in a given year. While the bankruptcy filings are not specific to construction, one would assume the proportionate share by industry remains somewhat stable over time. A key highlight is the increasing interest rate trend from 2003 through 2006, followed by a sharp decline in 2007. It appears there is a three-to-four-year lag in rate increases driving increased bankruptcy filings. Based on the sharp increase in rates beginning in 2021, there is a high likelihood we will begin to see increase bankruptcies starting as early as 2024.

Source: JP Morgan Chase & Co. / Historical Prime Rates & Statista / U.S. Number of Business Bankruptcy Filings Nationwide

Credit Availability & Financial Management

With uncertainty in the economy and increased costs across the board, it should be understood that credit partners are tightening their underwriting requirements. This means contractors’ sureties and banks will require a stronger financial profile to qualify for a similar level of credit they have in the past. Paying close attention to the financial management of your construction company will help ensure the same level of support as we work through some of the current economic challenges. There are a few things contractors can do to help their credit partners continue to provide support:

- Financial Reporting – be timely, accurate and provide complete information. The sooner a creditor has the information, the faster they can make decisions on extending additional credit when the need arises. Best-in-class contractors are producing monthly financial statements within 25 days of the prior month-end, to include actual-to-budget comparisons for forecast tracking. All contractors should also put in the necessary time to prepare financial projections for 2024, and if possible, 2025.

- Increased Capitalization – when a challenge presents itself, contractors need to have the necessary “loss paying power” to overcome the challenge and continue their business. Contractors who focus on growing their balance sheet (both Working Capital and Equity) will be in the best position for consistent support from creditors. This means retaining profits in the company and limiting equity distributions outside of tax liabilities. Sorry… the new boat will have to wait.

- Underwriting Questions – as underwriting requirements tighten, it should be expected more questions will be asked by a surety and/or bank. Contractors who take the time to provide complete, thoughtful responses to these questions will be in the best position for continued support. While these questions may be frustrating, underwriters ask questions because there is a potential risk (often financial risk) to the company – and they want to make sure it’s been recognized and addressed.

- Develop Relationships – continue to build on your relationship with your surety broker, surety underwriter and your banker (and other professional advisors for that matter). When it comes to a tough decision, creditors are more likely to make a favorable decision for clients they have built a meaningful relationship with. Construction is a relationship-based business, and your creditors view it that way.

Labor

Finding adequate skilled labor to complete work will remain a challenge; however, there has been positive traction in educating our future workforce of career opportunities in construction. Adding to the challenges locally in California, booming construction in bordering states continues to draw labor from the workforce pool for mega-projects which will be under construction for at least the next couple of years. Retaining key employees and utilizing their experience to train the next generation should remain a priority in the coming year (and beyond). Contractors should also evaluate technology platforms that may help increase their efficiency both in the office and on jobsites.

- Project Labor Agreements (PLA) – the Biden Administration issued an executive order in February 2022 requiring PLAs on federally-funded construction projects exceeding $35Million. The final rule implementing this order was issued in December 2023, so any solicitation issued after January 22, 2024, will be subject to the rule. Add to this the ongoing conversation of PLAs at the state/local level, and it’s rather apparent most contractors will run into a PLA project in the near future. Understanding the pros and cons of these types of agreements will help contractors evaluate the opportunity before spending considerable time, effort and money bidding the project.

- Employee Growth & Development – it’s difficult to find good people, so contractors should focus on retaining the ones they have. Companies should consider an internal program for mentoring and developing the next generation. That could include a growth system where periodic meetings are held to develop career goals and strategize on achieving those goals or implementing a mentor/mentee relationship with senior personnel. The “transfer of knowledge” is quickly becoming the greatest challenge contractors see in their business continuing successfully.

- Recruiting & Community Outreach – we’ve talked about the shortage of skilled workers for years. Without direct involvement from contractors, the labor shortage will continue to be a topic of conversation for years to come. Get involved in your local trade associations, high schools, vocational schools, and universities to help communicate the career opportunities in construction that others might be unaware of. Young people who are unsure of their career path want to hear of new possibilities– especially from those who have made a successful career doing what they love. Did you happen to see Home Depot’s new ad during the college bowl games? Check it out here: Going Pro | The Home Depot

- Implementing Technology – with a strained workforce and continued challenges to fill positions, it’s important to lean on new technologies to help increase employee production. The construction industry has seen considerable growth in the emergence of new construction software, including project management, financial & accounting, administrative processes, and even the introduction of artificial intelligence. Utilizing the right software is crucial to bridging the talent gap.

Business Planning

Planning is critical to any business, but contractors should put extra effort into this process during challenging economic times. Considering what has and has not worked in the past, will help contractors determine what opportunities will be the best investment. . Additionally, Contractors should consider the long-term vision for their company, as it can take years to have the right people in place and transition the business successfully. There are finite ways to transfer or close a business, and it is never too early to think about how you want to “go out”. The only way you know which way to turn is by knowing which direction you want to go.

- Business Plan – some companies have a business plan – every company should, and it should be updated annually. As business environments, teams, relationships, and the economy evolve, it is important to adapt to these changes and reflect this in your business plan. This demonstrates to outside parties that a plan exists and gives them a great sense of confidence in the motivations and sophistication of your company.

- Continuity & Succession – as the Baby Boomer generation gets closer to retirement, the importance of having a complete Continuity and Succession plan grows. Construction companies are successful because of their people and their processes. Taking the time to identify those key people and document your procedures will help maximize the value and viability of the business when it’s time to exit. This type of planning is a process and typically takes six to eighteen months to build and implement a plan. Once implemented, it may take between five and ten years to execute that plan, so it is best to start planning sooner than later.

With all of this to consider, there is a key component that will help in all areas – proactive communication. This concept should be practiced both internally and externally. Nobody likes problems, but the sooner everyone is aware of an issue, the faster a solution can be developed. Making sure project teams are proactively sharing project updates with the home office is vital to ensuring management has the necessary information to keep the company moving forward.

There are amazing opportunities in construction – whether that be a career, new project, new relationship, or other business ventures – each of those opportunities will present itself to contractors in some fashion in 2024. Taking prudent steps to protect your company will ensure you have the ability and support to capitalize on new prospects in the year ahead.